Applying to college is an exciting time in any student’s life. Applying for financial aid, however, is often less inspiring. Terms like “subsidized” and “unsubsidized” loans may seem like gibberish to college-bound students. The average student debt climbed to $37,000, according to Forbes.com, making it more important than ever to understand the borrowing process.

Let’s demystify both types of federal student loans by breaking down their similarities and differences. This information will help you determine which loan(s) may be right for you.

Understanding Federal Student Loans

Both subsidized loans and unsubsidized loans are granted through the U.S. Department of Education. The names of these loans are used interchangeably with the terms “Stafford Loans” or “Direct Stafford Loans,” respectively. Students should keep this in mind while weighing their borrowing options.

Also note, federal student loans are available for those students enrolled in four-year universities and graduate programs, as well as community colleges and trade schools.

Subsidized and Unsubsidized: The Similarities

In both cases, the college or university will decide how much a student can borrow each academic year. To qualify for a federal student loan, the student must be enrolled at least half-time, and in most cases, he or she must be working toward a degree or certificate offered by the institution.

Borrowers must begin repaying both types of loans six months after graduating or leaving school. At that point, students will make monthly payments. The loan must be paid off within a ten-year period.

Take Note: Currently, the interest rate for both subsidized and unsubsidized loans is 3.76 percent for undergraduates and 5.31 percent for graduate students, according to The Institute for College Access & Success. There are also additional fees based on the loan amount.

The Skinny on Subsidized Loans

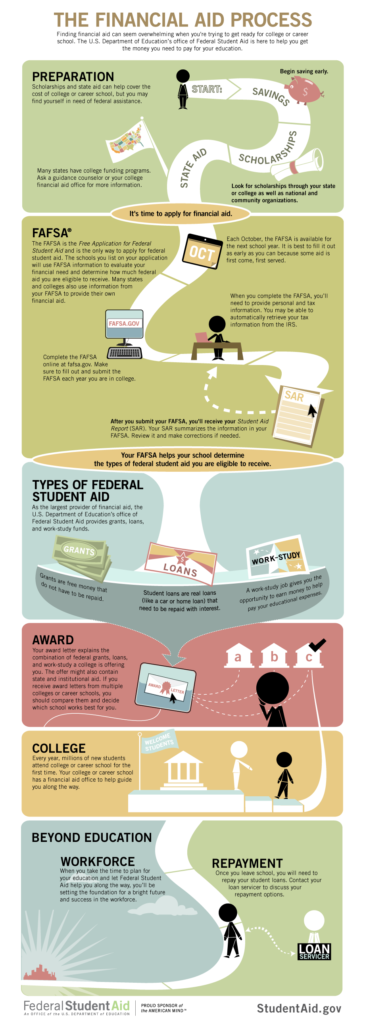

Colleges determine a student’s eligibility for subsidized loans based on financial need. After the student completes the Free Application for Federal Student Aid, the school calculates the loan amount, which is then offered to the student. This is an annual process.

The U.S. Department of Education will continue to pay interest on subsidized loans as long as the student is enrolled at least part-time, as well as during the grace period.

Take Note: Students are given a grace period of six months after graduating from or leaving college. Students are sometimes able to defer their loan payments beyond the six-month mark. In this case, the U.S. Department of Education will continue to pay the loan’s interest.

The Lowdown on Unsubsidized Loans

Unsubsidized loans differ from their subsidized counterpart in that the unsubsidized option is not based on financial circumstances. The school will determine an amount by considering the cost of tuition and other college expenses, as well as any additional financial aid a student is granted. Students whose status is “dependent” at the time of application may qualify for additional unsubsidized loans, if their parents don’t qualify for a Direct Plus Loan.

The unsubsidized loan option is available to both undergraduate and graduate students, but keep in mind, the U.S. Department of Education will not pay interest on these loans. The student is responsible for all accrued interest. Students can opt to pay interest on their loans while enrolled in college. If students opt out, the accrued interest will be added to the loan’s principal.

Other Important Notes

Subsidized loans have limits. According to studentaid.ed.gov, a student may not be granted a loan after reaching 150 percent of the published length of his or her college program. In other words, a student enrolled in a four-year program is eligible for subsidized and unsubsidized loans for a total of six years. Students should be sure to ask about the maximum eligibility period for his or her area of study. The maximum eligibility period may be modified if a student opts to change programs.

Students should also know they can decline any federal loan offered. After determining a loan amount, colleges prompt students to fill out an online form to either accept or decline the partial or full loan amount.

It’s important for students not to borrow more than necessary.

Crunching the Numbers:

- First year undergraduate students with a “dependent” status may be granted up to $5,500 in combined federal student loan money, up to $3,500 of which can be subsidized.

- Independent students (and dependent students whose parents don’t qualify for a Direct PLUS loan) can receive up to $9,500, with the same $3,500 cap for subsidized loans. These amounts increase for students annually as they continue through their programs.

- Dependent students’ overall combined federal student loan amount tops out at $31,000, of which $23,000 may be subsidized.

- Independent students’ overall combined loan amount is capped at $57,500, with the same $23,000 subsidized limit.

- Graduate and professional students can borrow up to $138,500, with a $65,500 cap on subsidized loan money.

You’re Not in This Alone

For additional information on federal student loans, students are encouraged to make an appointment with their college’s financial aid department. Understanding subsidized and unsubsidized loans will help to streamline the borrowing process and empower students as they begin this exciting new journey.